How to Invest in Real Estate For Dummies Who Aren't Dummies

So you want to invest in real estate but have no idea where to start, right? That’s very understandable as it is a pretty big deal and can be totally confusing when you are new. We want to help you on this journey, so we put together a basic guide for investing in real estate. By the end of this guide, you should have an idea of the direction you should begin in.

Understand What It Means to Invest in Real Estate

We will start with the basics- understanding what it means to invest in real estate. The phrase “invest in real estate” is a pretty vague one, and that phrase covers a multitude of possibilities. Before you get started investing, you need to be clear on what approach you want to take as it determine your course of action. We will quickly break down some basics before moving on.

There are two basic ways you can invest in real estate: Hands off and hands on:

Hands Off Approaches to Invest in Real Estate

For those who want the rewards without a ton of work, you can invest in real estate through stocks, mutual funds, private equity funds, and more. This is usually a cheaper way to start investing in real estate, though that depends on the investment you choose. Basically, you put in the money and someone else manages the stock, so it is a really passive way to make money from real estate.

Hands On Approaches to Invest in Real Estate

Some people like to really be involved in their real estate investments. Those people use one of the following three approaches:

1. Owning Your Own Home

Though owning your own home does not bring in additional income- unless you rent out a room or something similar- it is still a good and popular investment. Owning your own home increases your net worth, which can impact your life in great ways. Also, as homes typically appreciate over time, you have the chance of reselling it later and making a good profit.

Sometimes when people say they want to invest in real estate, they simply mean they want to own a home. Most people, though, mean one of the two following options.

2. Owning Rentals

Owning rentals is a great way to bring in ongoing additional income, but it does come with some risks and downsides:

There may be times your rental sits empty, leaving you to pay the monthly mortgage payment on top of your regular bills.

When a tenant moves out, you have to take some time to clean the place up and usually repaint it, too. This means more money spent and more time it is not making money.

You are responsible for repairs, even if your tenant calls before the sun is up. If there is a problem, you have to solve it either yourself or by calling in someone else to do it.

You may have to deal with tenants who will not pay or those that damage your property.

If you choose to hire a property manager to handle all of this for you- a very smart move for most new investors- you are adding another expense. Having a property manager is still more hands-on than hands-off because you are still making active decisions about the property.

If you want to invest in real estate rentals, you have to be prepared to handle these challenges and more.

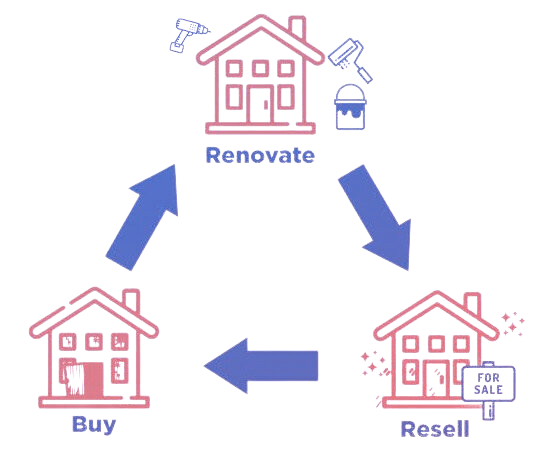

3. Flipping Houses

Then, there is the ever-popular house flipping. This is when you purchase a home, repair and renovate it, and then sell it as quickly as you can. It is what you see on those really inspiring HGTV shows. Who doesn’t feel like they could take on a fixer-upper after watching those?

The problem is that those shows do not tell all. Even if they let viewers in on some of the struggles they face, there are many things that go on off the camera. And, let’s not forget, those people have the financial resources and the people they need to pull it all off in a 30 minute TV show. I am not saying do not get into flipping houses because it can be a really good thing. I am just saying that there is more to it than we see on TV.

House flipping is intended to be a pretty quick process, many people enjoy turning something old into something new, and you can make a pretty penny doing it. Sometimes, you can bring in a really nice profit from it, but like all things in life, it also comes with risks and downsides:

You might discover problems that you did not know you would face. This is one of the most frustrating things ever. My husband and I bought a fixer-upper about five years ago. We were told that there were a few issues but that most of the work would be cosmetic. We thought that we could fix it up and make it a nice little home for our family. Hah! Boy, were we wrong. It turns out that we needed all new plumbing and electrical components all through the house. The roof leaked in way more places than we were aware of. The floors all needed to be replaced thanks to the water standing under our house. The list was never-ending. You should always expect more problems than what you think you are facing.

You have to get good prices on the home and the supplies or you risk losing money. First and foremost, you need to get the house itself at a good price. Second, all of the supplies and any professionals you hire will need to be a really good deal. If you pay $50,000 for the home and the renovations but only get $45,000 from the sale, you have just lost $5,000. Before you jump in head first, research where to get great prices on supplies. Learn how to do what you can so you do not have to pay anyone. However, when it comes to any electrical work, hire someone.

There is the chance you will not sell it as quickly as you would like. You might get fortunate and sell it right away, but what happens if you fix the place up and it is on the market for a whole year? It can happen. If it sits there too long, you may have to accept a lower sales price than what you put into it.

This avenue is great for some people, but you need to ask yourself if you can handle these risks before you jump into. Do not make rash decisions. This is your future we are talking about. Take time to think it through.

Steps to Invest in Real Estate

If you decide that you are ready to invest in real estate, it is time to get to work.

Pick Your Poison

As I said, you need to know how you want to invest in real estate so that you can take the right path. We discussed them above, so which of those avenues do you want to take? For those looking for stock and fund investing, you can do this through a brick and mortar financial advisor or online. If you are looking to either own rental property or flip houses, you have a few extra steps to take.

Decide on a Means to Pay

Depending on how you want to invest in real estate, there are a few different ways to purchase it.

1. Equity in Your Home

If you own your own home and have enough equity in it, you can use that equity to purchase the new home. Using your house equity, though, means a second loan, so consider that.

Most lenders will allow you to borrow up to 85 percent of your home’s value after subtracting what you owe. For example, let’s say your home is worth $100,000 and you still owe $50,000. That gives you $50,000 in home equity. There is a good chance you can borrow up to 85 percent of that $50,000, which would be $42,500. Some lenders loan more and some less.

You could use that $42,500 to purchase your new home- or pay a good chunk of it, depending on the purchase price. This is an option, but again, it is a second loan. Before deciding, be sure you consider the next option.

2. A New Mortgage

There are, of course, completely separate mortgages to consider. In this case, you will just get a new mortgage loan for the new property. This could be a good move, but you will not know until you compare the rates and terms of a new mortgage to that of the other options.

If you cannot get a regular mortgage loan due to your credit, there are other loans to consider. Some lenders will approve a loan for an investment property according to the profitability of the property as opposed to the borrower’s information.

3. Refinancing Your Current Mortgage

You may also be able to refinance your current mortgage for a large enough amount to purchase the investment property. This way, you have only one loan and one monthly payment to keep up with. Choosing between these two options will require you to talk to some potential lenders to determine which might offer a better interest rate and terms. Below you can take a look at today's mortgage rate's:

Calculate

Before you do anything else, you need to determine what you can afford each month. Remember, we talked about the fact that rental properties might sit empty for a while or that tenants will not pay. In those times, the mortgage payment will be coming out of your regular income.

This means you need to determine how much you could afford to pay monthly if this happened. Whatever that amount is, be sure that your mortgage payments will be that amount or lower prior to signing any documents.

When it comes to mortgage with flipping houses, it is a whole different ball game. The entire time it is being worked on until you sell it, you will be paying for it. On top of the mortgage, you have to pay for the renovation and repairs. The best option when flipping houses is the just pay cash, but that is not always an option.

If you must take out a mortgage for flipping a house, aim to get enough to cover repairs as well. At least that way you will not be stretched too thin financially. Also, just like with rental properties, you need to know how much you can cover each month until you sell the home.

Find Your Lender

If you are borrowing money in any way to invest in real estate- mortgage, home equity- you need to compare lenders. This is important for everyone, but especially if you are taking on a second mortgage. You need to spend some time rate shopping to ensure you get the lowest rate possible.

Find Your Property

No matter if you are investing in rentals or flipping houses, the property you choose is important. Purchasing a home in a run-down neighborhood is not necessarily a terrible thing, but it will impact the value of your investment. There is always a chance that the area will get fixed up, but until it does, your profits may not be too high.

Neighborhoods that have newer homes or homes currently being built tend to be a better option. Homes close to new businesses, good schools, grocery stores, and other conveniences are also good options. The purchases price of a home in these types of areas will undoubtedly be higher, but you can ask for more in rent, too. Still, be sure that you can handle the mortgage just in case.

Have the property appraised and inspected prior to purchase. An appraisal will tell you whether you are paying a fair price. An inspection can help you discover problems with the property. It is very, very important to note something here: Inspections are not going to find everything and you should not expect them to.

For More Tips on Real Estate - Join The Accury Store.

Other Tips

You may want to invest in real estate in more than one way. That is okay- it might work very well for you. If you choose to both own rental properties and flip houses, it is usually wiser to start with rentals first. This way, you can have rental income coming in while you are working to renovate homes. While it may not cover all the costs, it can ease the burden.

More homes sell in the spring and summer than the rest of the year. If you want to flip houses, aim to have them ready to sell by spring to take advantage of this trend. Houses that are empty in the cold months tend to stay that way until it warms up again. If you set up your renovation timeline to work with these seasons, you have a greater chance at success.

If you are new to investing in rental property, most experts suggest you start with a single-family home as they are easier to manage, especially while you are learning the ropes.

Do not shy away from asking for advice or seeking help. There are people who will help you, the courses you can take, articles you can read, and more. There is a lot of moving parts when it comes to investing in real estate and you are not going to be a pro at them all.

Conclusion

We hope this guide gave you some clarity on how to start investing in real estate. If you feel you need further information at this time, seek out additional resources. Educate yourself as much as possible before you take the first step. While there will be much more learning along the way, preparing yourself now will make you feel more confident and ready to take on this new and exciting journey.